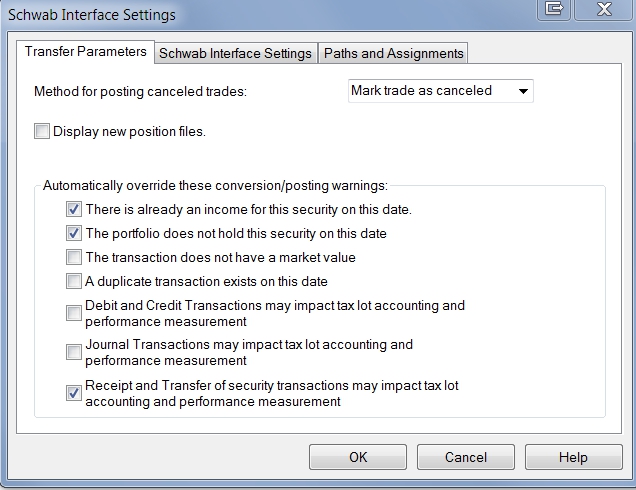

Confused about what settings to choose in the Schwab Interface Transfer parameters? Here is what I recommend.

Method for Posting Canceled Trades: Choose “Mark Trade as Cancelled”

This setting determines how corrections are handled. The options are: 1) delete the transaction from the ledger or 2) mark the transaction cancelled and keeping it in the transaction ledger.

Typically corrections stem from management fee adjustments and/or dividend adjustments. Choosing “mark as cancelled” leaves a helpful in “rabbit trail” but does not change the position. Leaving a trail is particularly useful for management fee corrections.

Display New Position Files: Unchecked

Typically you would check this field only when you initially set up the Schwab interface. After that, leave it unchecked.

If you are expecting a large number of transfers from within Schwab (such as accounts moving to your management from another Schwab advisor or from Schwab Retail), you could check this field, process the transfers and then uncheck it again. But if you are newer to PortfolioCenter, I wouldn’t try this method.

Automatically override these conversion/posting warnings

These check boxes allow you to decide which warning and error messages you’ll receive when converting transaction files. Schwab Performance Technologies recommends unchecking all of them except the Receipt & Transfer message.

I agree that Schwab’s recommendation is the safest method, but it is also the slowest in daily practice.

Once you are familiar with the style of trading and investment philosophy of the manager(s) generating the data and with the quality of data coming from the broker, you can safely check the top two warnings. But in each case I would only check these boxes after routinely seeing that your data typically “safely breaks” the rules.

- “There is already an income for this security on this date.” – Some funds routinely receive more than one dividend on the same day. IF you hold such funds (and you know it), it is safe to check this box. IF you are unsure, leave it unchecked.

- “The portfolio does not hold this security on this date.” – Many positions will receive a dividend payment after the position has been sold. Checking this box allows those dividends to be posted without warning. Again, I would only check this after you’ve become familiar with your data, trading and situation and you know that your data frequently falls into the “dividend after sell” category.

- “A duplicate transaction exists on this date” – For some managers duplicate transactions are a regular occurrence, particularly if you trade a lot of individual equities. If this type of trading is part of your practice, you could safely check this box.

Never check the remaining boxes: :The transaction does not have a market value,” “Debit/Credit” and “Journal Transactions.” Checking these boxes can skew your performance and your cost basis reporting.

For the null market value and debit/credit, it is best to handle these transactions individually and post only when you know they are correct.

Journal transactions should never be posted. Journals should always be recoded to something else depending on what has happened in reality.

Too many cooks spoil the PortfolioCenter broth

Bottom line: There’s no substitute for knowing your PortfolioCenter data, your trading style and the types of transactions typical in your practice. For best results in performance and cost basis, the same person should post and process your PortfolioCenter database daily, so he/she can make these choices intelligently.

In PortfolioCenter processing, too many cooks definitely spoil the broth.