by Krisan Marotta | Nov 27, 2012 | Cost Basis

Thanks to the Emergency Economic Stabilization Act of 2008, custodians and broker-dealers are required to report the adjusted cost basis of sold securities to the IRS and taxpayers on Form 1099-B — including whether the gain/loss is short or long term....

by Krisan Marotta | May 29, 2012 | Cost Basis

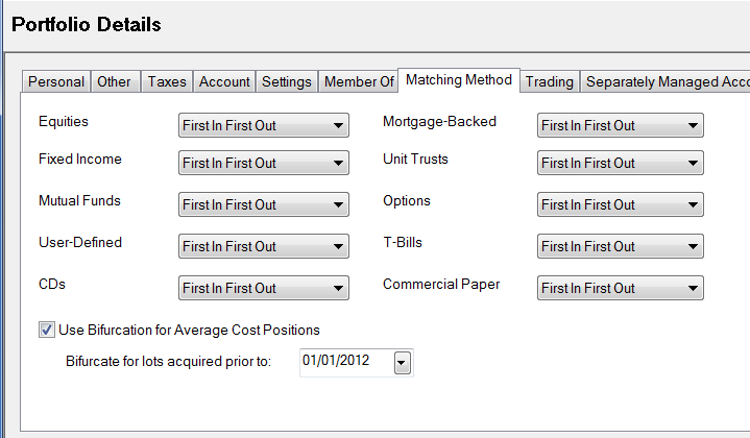

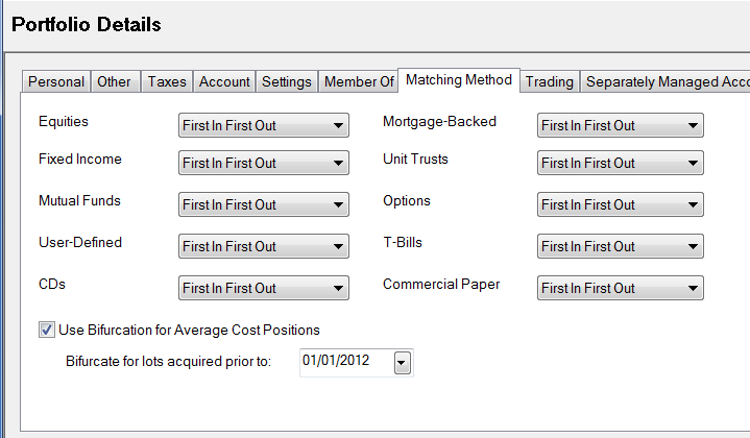

PortfolioCenter 5.5 makes it easier to manage bifurcated average cost positions. On the Matching Method tab of the portfolio details, you’ll find a new Bifurcation Handling check box. By default, this box is checked and set to bifurcate lots acquired before...

by Krisan Marotta | Jan 13, 2012 | Cost Basis

Bifurcation threatens to be the monster that devours all your time! If you reset your cost basis in PortfolioCenter to move out of average cost accounting January 1 2012, what do you do with transactions that arrive in January but which are backdated to December? ...

by Krisan Marotta | Jan 5, 2012 | Cost Basis

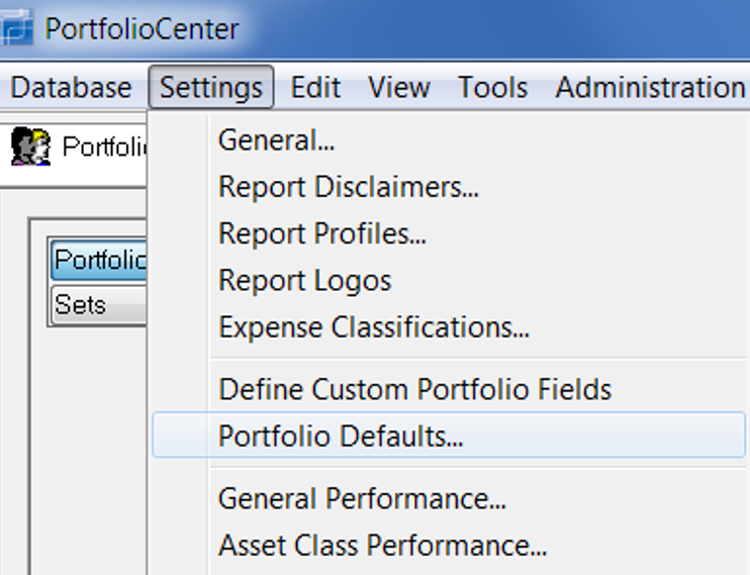

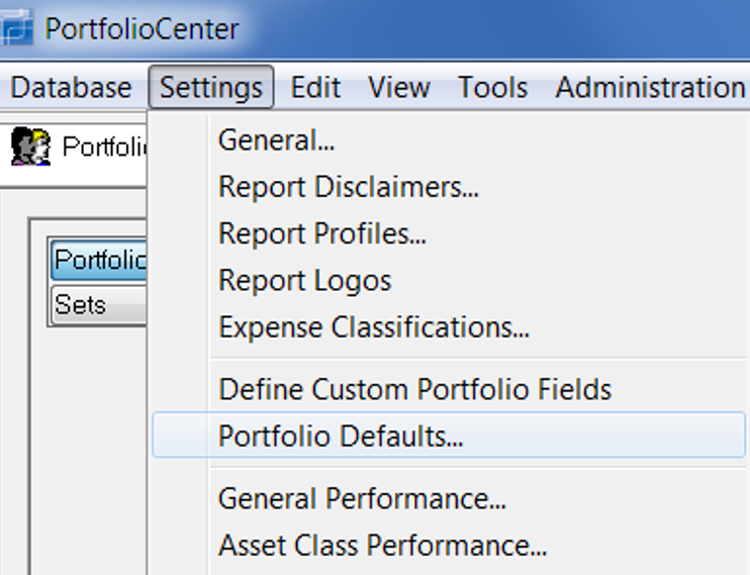

There’s an additional step you may need to take which is not discussed in the PortfolioCenter documentation for dealing with the bifurcation of average cost mutual funds. If you plan to switch from average cost accounting long term, you should change your...

by Krisan Marotta | Dec 27, 2011 | Cost Basis

With the new IRS tax reporting regulations, average cost positions will be bifurcated. Thanks to government regulation, covered and uncovered shares will now maintain a separate average unit cost which require manual data entry in PortfolioCenter to maintain accurate...