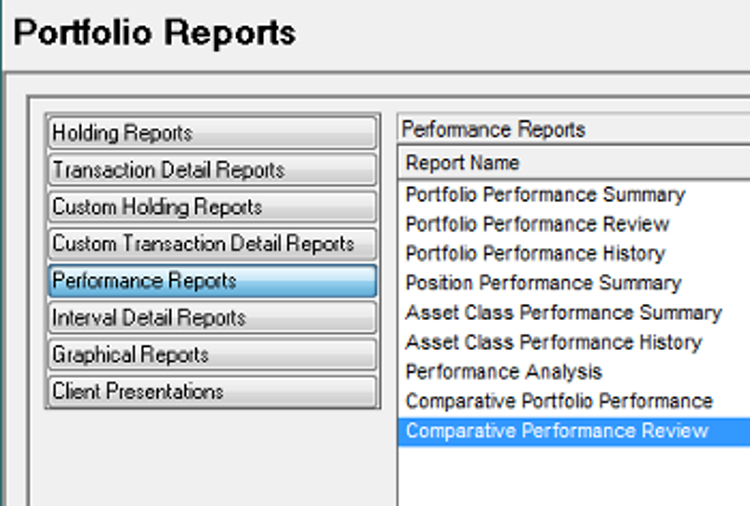

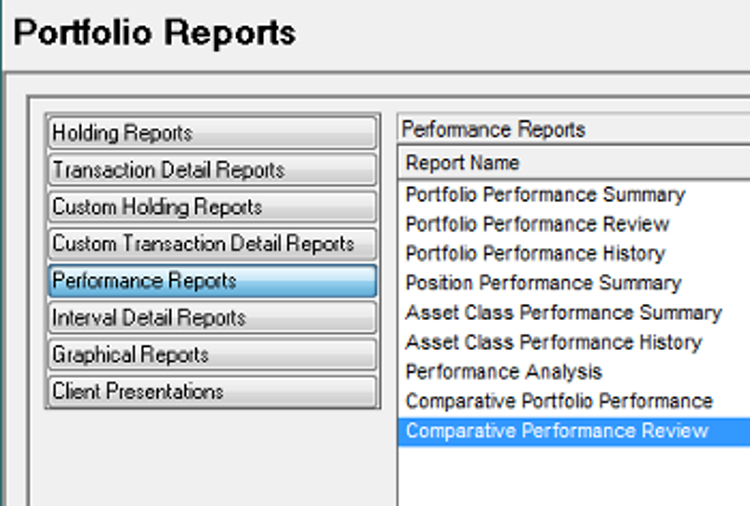

Wondering what the columns mean on the various Schwab PortfolioCenter Performance Reports? Here’s a brief explanation.

Beginning (BV) = The total market value of the portfolio at the beginning of the reporting period. This values comes from the intervals.

Net Contributions = The total of all securities and cash deposits added to or subtracted from the portfolio during the reporting period.

Contributions (C) = Cash deposits plus the market value of securities deposited into the portfolio during the reporting period.

Withdrawals (W) = Cash withdrawals plus the market value of securities transferred out of the portfolio during the reporting period.

Note: If you’re reporting on a group Contributions and Withdrawals may include cash and securities transferred between accounts in the group.

Capital Appreciation = The change in value, excluding additions and withdrawals, during the reporting period (realized gains + unrealized gains).

Realized Gains = Total of the capital gains realized on the sale of securities during the reporting period.

Unrealized Gains = Total change in value during the reporting period.

Note: These gains are NOT taxable gain. These gains are computed from the market value of the security at the beginning of the reporting period, not from the purchase value.

Income = Total of all interest and dividend income during the reporting period

Interest Income = Total interest received during the reporting period.

Dividend Income = Total dividends received during the reporting period.

Total Expenses = Total of all expenses including management fees during the report period.

Expenses = Total expense transactions during the reporting period, excluding management fees.

Management Fees = Total expenses marked as management fees during the reporting period.

Change in Accrued = Net change in accrued interest on fixed income securities, during the reporting period.

Ending Value (EV) = The total market value of the portfolio at the end of the reporting period. This values comes from the intervals.

Investment Gain (IG) = The dollar amount that makes this formula true for the reporting period: BV + C – W + IG = EV

Need a quick answer? Ask a question and I’ll try to answer with a blog post.